It's all in the index you choose

Canadian and U.S. stock markets get equal treatment on the evening

news but it's easy to forget just how different they really

are. Investors, though, have had the distinction pressed upon them

this year, as the S&P/TSX 60 has slid 14.5 per cent, while the Dow

Jones industrial average (DJIA) has risen 6.8 per cent in Canadian

dollar terms.

To see what's going on, you have to look under the hood. Once you do,

the gaps between the two indexes loom large.

The DJIA is the granddaddy of market gauges and it follows 30 of the

most important firms in the United States. It's technically a scaled

average rather than an index because the portfolio it follows is

weighted by stock price. As a result, stocks with higher prices make

more of an impact. IBM and Chevron are the most influential at the

moment.

The S&P/TSX 60 index follows the performance of 60 of the largest

stocks in Canada. Like most other broadly based indexes, it's weighted

by market capitalization (shares outstanding times price per share),

which means that it tracks a portfolio that holds more of the largest

stocks and fewer of the smaller stocks.

While the S&P/TSX 60 tracks a greater number of stocks than the DJIA,

the reverse is true when it comes to the size of the individual stocks

that each holds. To get a quick sense of scale, there are about 350

stocks in Canada that have market capitalizations in excess of

$500-million while the U.S. has roughly 1,900 such stocks.

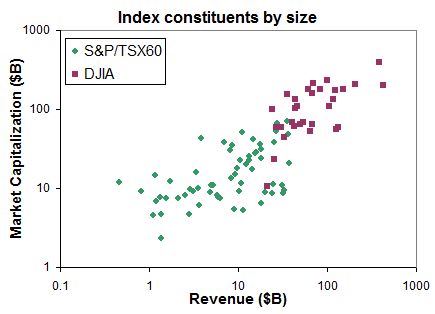

The accompanying graph plots the market capitalization of each

company in the DJIA, and the S&P/TSX 60, versus its latest annual

revenue using data from globeinvestor.com. (A log scale is used on

both axes of the graph to allow for the easy comparison of wildly

different figures.) You can see that the stocks in the DJIA all

cluster at the top right of the graph, which makes them much larger on

both measures than the stocks in the S&P/TSX 60. That is, they

generally have bigger market capitalizations and revenues. Simply put,

the DJIA truly follows huge stocks whereas the S&P/TSX 60 merely

tracks large stocks.

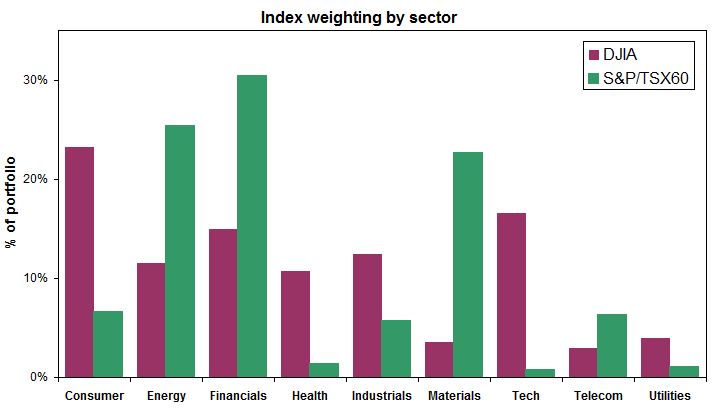

The types of businesses in each benchmark are also different. The

accompanying chart also highlights the distinctions and it shows

the percentage weighting of each sector based on data from

ishares.ca. Stocks in the financials, energy and materials sectors

(think banks, oil and gas, and mines) dominate the Canadian market. On

the other hand, the DJIA has more technology, industrials, health care

and consumer-oriented firms.

[larger graph]

One can easily point to even more differences, but the contrast should

already be clear. For investors, disparity can be a good thing because

two such distinct benchmarks offer diversification possibilities. Just

don't expect the indexes to follow each other in lockstep.

First published in the Globe and Mail, December 17 2011.

|

|